Call Now: 973.200.2763

Collect More

Increase collections with flexible payment options.

Faster Cash Flow

Digital-first billing that speeds up payment.

Patient-Friendly

Clear, mobile-friendly billing and click-to-pay.

More Than Payments: A Smarter Way to Power Your Practice

Broad payment solutions for all industries, specialized strategies for healthcare providers.

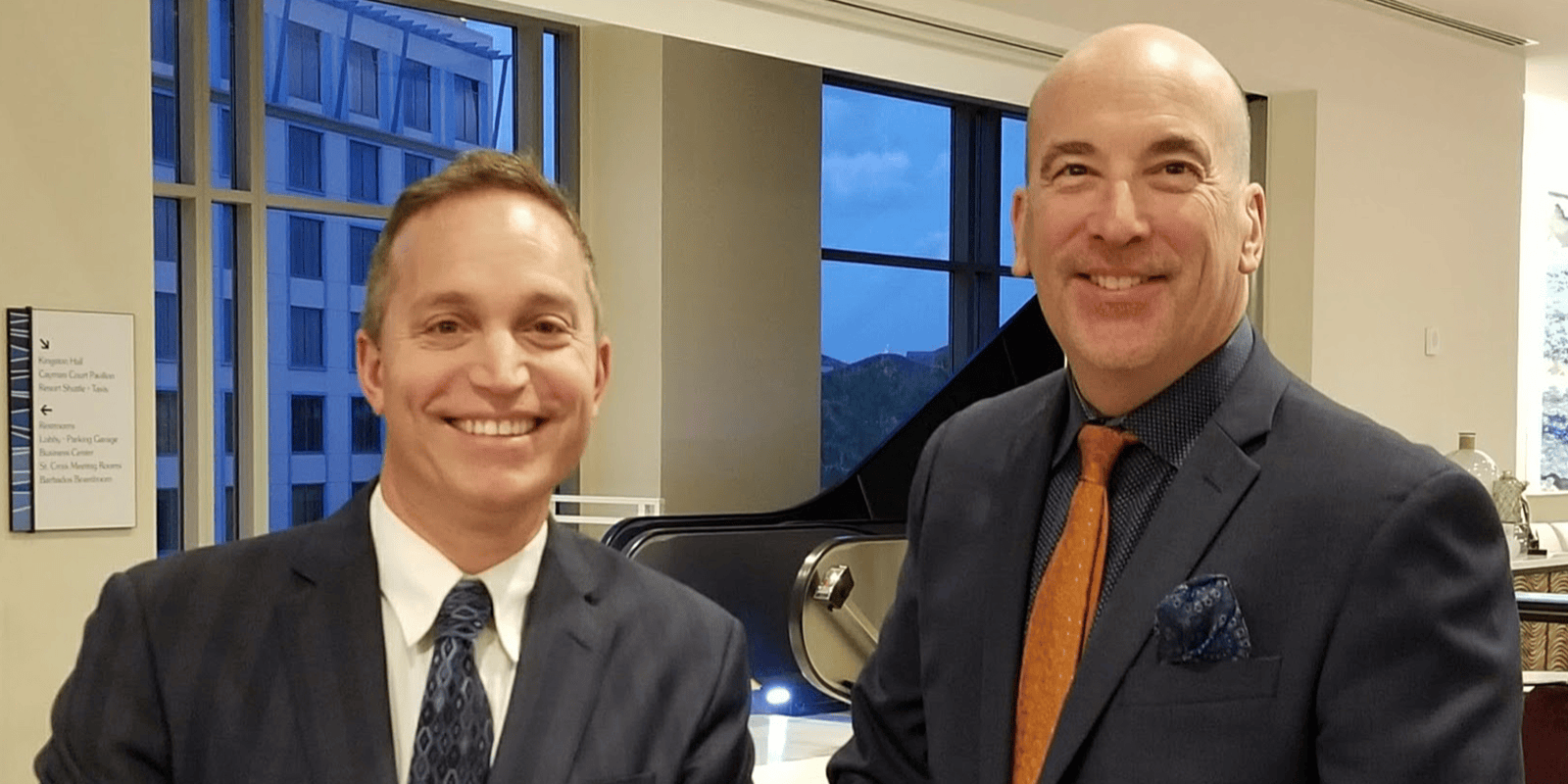

About Us

Trusted Advisors to Healthcare Professionals

For over 20 years, CardChoice International has been a trusted partner to medical practices nationwide. Founded in 2003 by Ray McGrogan, CEO, and Steven Kleinberg, COO, our mission is to help providers succeed through smarter, patient-friendly payment solutions.

Active in the Medical Community

We don’t just provide technology—we share knowledge. Our team has spoken at national and regional healthcare conferences and contributed articles for leading organizations including AMBA, PMI, NJAOP, Telehealth.org, NAMAS, APTANJ, and the NYSSCPA. This direct involvement keeps us connected to the daily realities of healthcare practices and ensures our solutions address the challenges you face.

Seamless Technology Partnerships

CardChoice also collaborates with leading healthcare software providers, integrating payments directly into EHR and practice management platforms. These partnerships create a seamless, secure experience for both practices and patients, helping providers save time, stay compliant, and strengthen revenue.

Built on Values That Matter

Every solution we deliver is grounded in our core values: Knowledge, Integrity, and Trust. They are the foundation of our business—and the standard we bring to yours.

One Partner, Many Solutions: Banking, Payments, Payroll and Beyond

Consolidate your back-office systems with a single trusted partner.

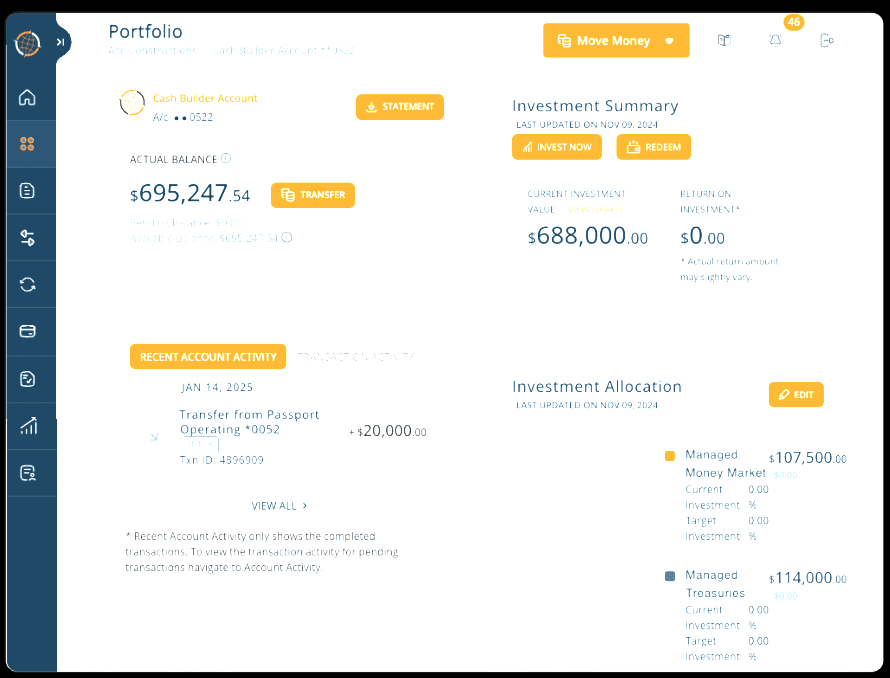

Banking That Works as Hard as Your Practice

Managing a medical practice means more than patient care—it’s also billing, payroll, supplies, and compliance. With our Passport Banking, you gain faster access to funds and smarter financial tools designed to support your business.

Eliminate Credit Card Fees

The All-in-One Payment Solution for Providers on the Go

Streamline Billing & Payments in One Platform

- Virtual terminal & mobile app with print, email, or text receipts

- Secure patient account vault for recurring billing

- ACH, credit card, and reporting with analytics

- CRM for patient engagement & tracking and online payments

- Invoice & Recurring Billing

- Accept ACH (electronic checks)

- Surcharging & More!

Pay Suppliers by Credit Card, even when they don’t accept credit cards.

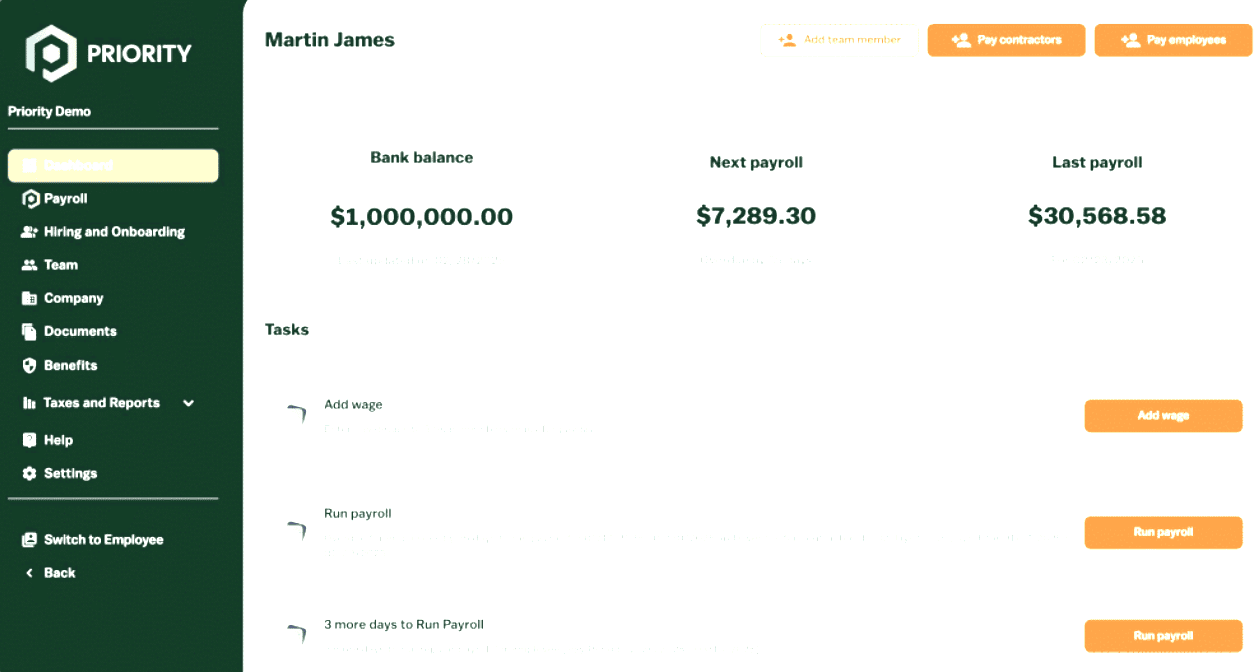

Payroll Made Simple - Better Payroll, Lower Costs

form

© Copyright 2025 | All rights reserved | CardChoice International

9 Law Drive | Fairfield, NJ 07004 | Phone: 973.200.2763 | Toll Free: 866.350.3200 | Fax: 973.954.2122 | Email: sale@cardchoice.com

CardChoice International is an agent for CardChoice Merchant Services LLC, is a registered ISO of Citizens Bank, NA, Providence, RI